Altyn-i

Mobile banking app for a major Kazakhstan bank.

Altyn Bank, one of the largest banks in Kazakhstan.

Request

Result

Technologies:

- iOS SDK

- Android SDK

- iD Mobile SDK

- PDF Viewer

Result

Results

-

All-in-One Banking

The app now encompasses all Altyn Bank products, including accounts, loans, and cards. Customer feedback highlights that money transfers have become exceptionally simple and fast. Users can easily check their account balance at any time and, when necessary, transfer funds to other accounts with ease.

-

Ongoing Collaboration

Following the successful launch of the mobile app, Altyn Bank invited our specialists to work on a web application project for Altyn-i. Today, Cogniteq is responsible for the optimization and implementation of the web version of the app.

-

Future Growth

As planned, our ongoing collaboration will focus on expanding the mobile app's functionality. Future developments will include phone number-based money transfers, cashback features, accumulated interest tracking, live chat with operators, and more.

-

Groundbreaking launch

The Altyn-i application became the first mobile banking app in Kazakhstan, marking a significant milestone for Altyn Bank.

Challenge

Solution

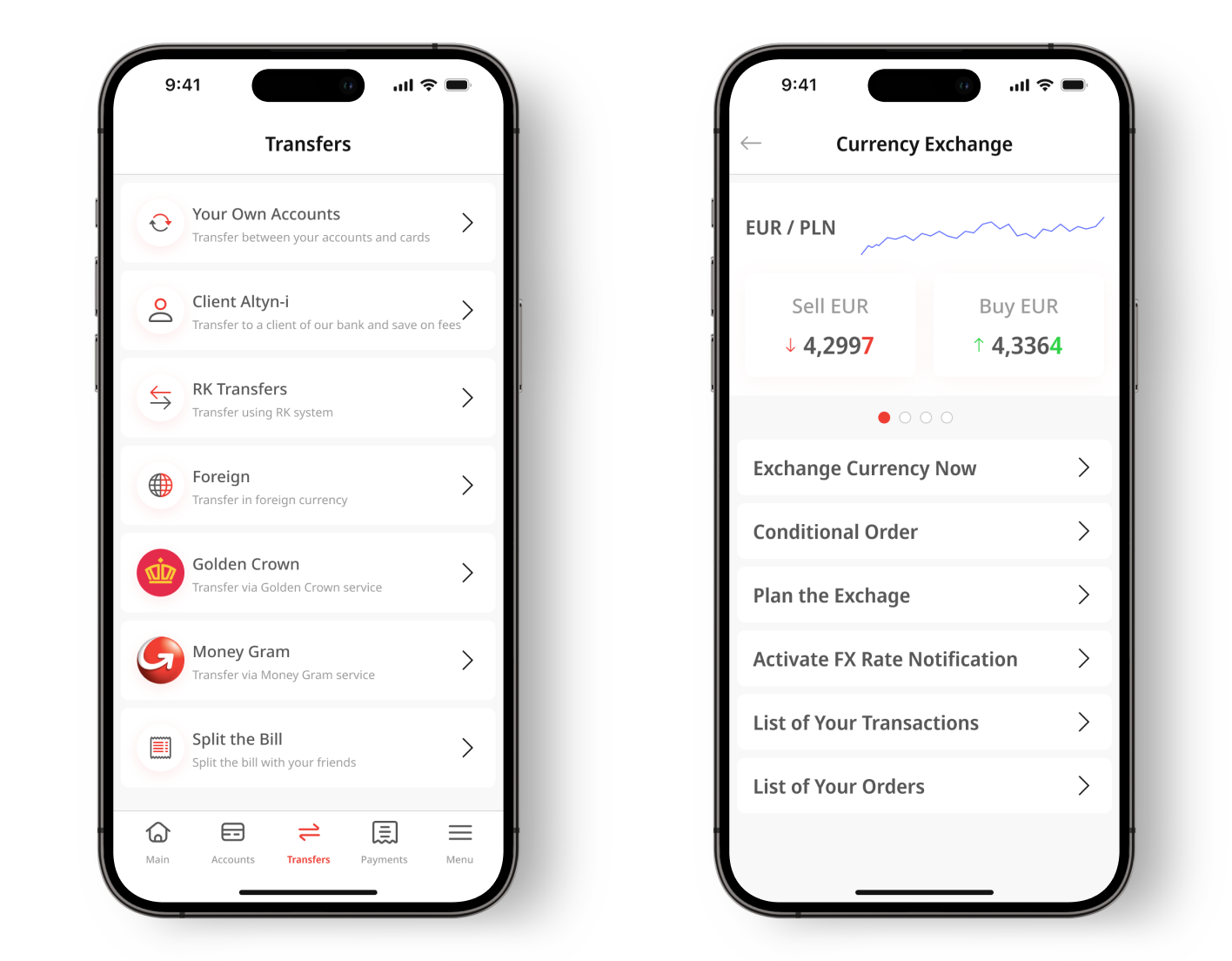

Our team designed features allowing users to make payments, top up Altyn Bank cards for free, and transfer money between cards or to a bank account. The app simplifies transferring funds between Altyn Bank cards and externally linked cards—users just need to enter their CVV/CVC codes.

We also created a dedicated payments tab and implemented several types of automatic payments. One allows users to set regular payments with specified amounts and frequencies, while the other offers flexible payments with customizable transaction limits.

One standout feature is the app’s automatic subscription system. For instance, after paying a tax bill, the system tracks and notifies users of new charges when they arrive.

Scalability

At the start of the project, we prioritized scalability to ensure the app could grow and evolve alongside Altyn Bank’s expanding needs. We designed a flexible architecture that would allow for seamless feature integration and the ability to handle increasing user demand. This forward-thinking approach ensures the app remains adaptable to future updates and technological advancements in the banking sector.

Security

We implemented all necessary industry-standard security measures to ensure complete data protection. These included secure authentication methods such as SMS verification, fingerprint scanning, and ID verification. Additionally, we integrated one-time passwords for transaction confirmation, 3D Secure technology for payment security, and set transaction limits on card payments to safeguard against unauthorized activity.

Development Challenges

The most complex task was developing payments based on custom scenarios, especially regarding business logic. While many operations seem similar to users, they differ significantly from a business standpoint, requiring precise handling to ensure accurate and secure transactions.

Testing

We created a range of test accounts, bank cards, and client profiles to cover different combinations of accounts, loans, and cards. During testing, we faced challenges with the banking APIs that seemed like bugs. For example, some operations could only be performed from an account, not a card. Developers had to be careful not to trigger API errors by incorrectly substituting card identifiers with account operations.

Key Features

The app offers 24/7 access to accounts, transaction history, and balances, along with the ability to open new accounts. Users can make bill and mortgage payments, open deposits, and apply for loans or credit cards. It also supports international money transfers and provides comprehensive card and account management. Additionally, the app sends SMS and push notifications for updates, fraud alerts, and new offers.